JeanNuma Caux

Contemporary visual artist.

Jean-Numa Caux, French contemporary artist.

I was born in 1974 in the red city of Marrakech. It is from its ramparts, its atmosphere and its colors that I draw my inspiration. The ultramarine blue or Majorelle blue of the famous French orientalist painter Jacques Majorelle is one of my signatures and invites relaxation. I came to the painting not by simple vocation, but by necessity, as if I had to express with color what my eyes captured day after day, at all costs and in urgency.

Through my paintings, I reveal a part of my inner world, my thoughts and my questions. It’s a very personal work, influenced by multiple currents from contemporary, oriental and western art. Each of my paintings reflects a great harmony between two sensitivities and two countries that I deeply love.

Agenda

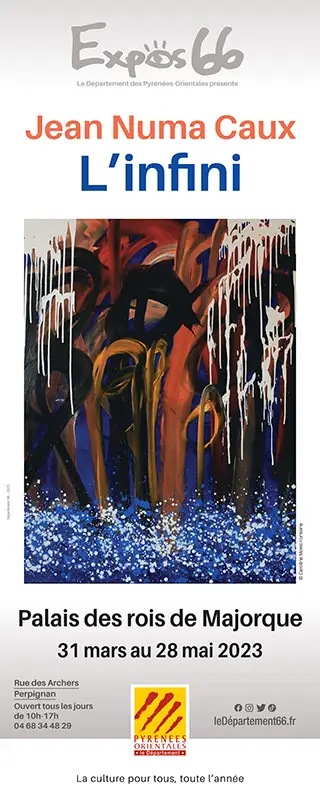

L’infini

I invite you to discover my new collection from March 31st to May 28th, 2023 at the Palace of the Kings of Majorca, on Archers Street in Perpignan.

Guided tour

Exhibition

House of Morocco Foundation

Gallery

21 rue de l’argenterie Perpignan

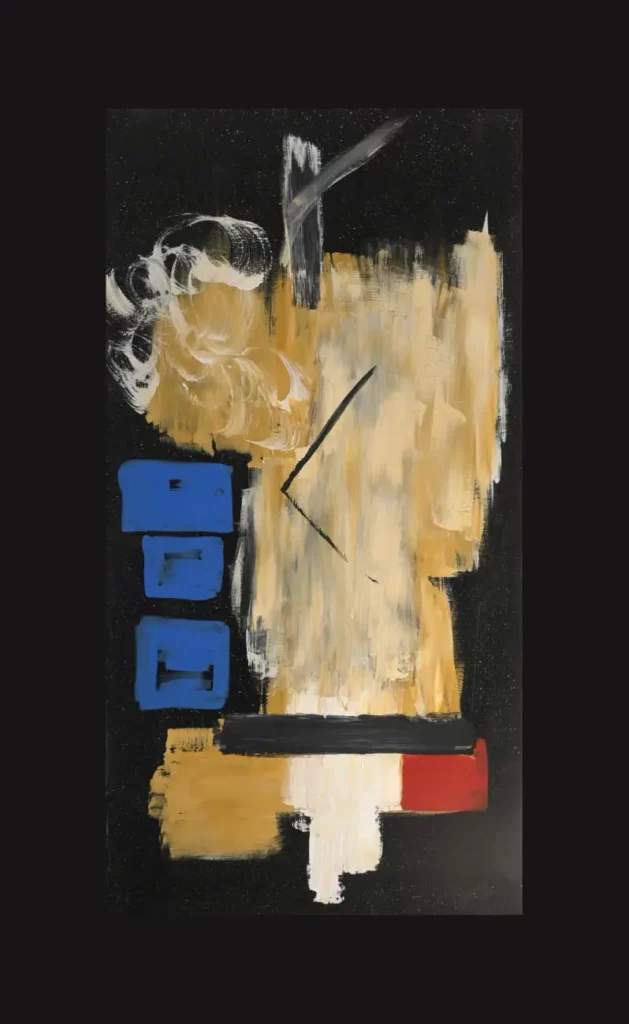

Inspired by American abstract painting, combined with my Mediterranean passion for deep blues and bright reds, I invite you to discover my entire collection at my Gallery Atelier by appointment.

Samourai

My work is influenced by Pollock and the New York abstract school, two mixed sensitivities that I captured from my travels on all continents. I work on the material in its thickness, unfolding it to bring it to life.

Berber Memory

The Deep Field series is introspective. Some works are dedicated to the Berber people. Canvases are filled with symbols, calligraphy, Arabic or even more remote. Here too, color explodes in drops, in spots, in broad strokes. These are all elements that carry a new search, in which the trace gains in scope, in brilliance, carried away by the movement.

What the critics say

“Jean Numa Caux is an artist who is passionate about colors. He has established his experience with a daring self-made approach. His work has been welcomed by a group of galleries in Morocco and Europe, and he holds a prominent position in the international arena of visual arts. Many art schools have turned to his work and consider him one of the innovators in the field of plastic art.”

Jean Numa Caux, artist.

The person who wrote this message has had a challenging history, but painting has been a lifesaver for them. Painting brings balance to their life and they listen to it. They carry a great deal of mental weight, but they release it onto the canvas through their brushstrokes. Every movement they make is connected to a thought they have, and when they paint, everything fits together like a puzzle. Painting is almost like a trance for them, and when they are in that state, they feel good and powerful.

NEW

National Academy of Contemporary Art and Dictionary of Listed Artists

Certificate of quotation.

The National Academy of Contemporary Art has carried out an appraisal of Jean Numa Caux’s works. Pierre Gimenez, an expert before the Court of Appeal, evaluated a price rating per square point (10x10cm) of €35 to €40 on October 12, 2022.

A tax device to defend art

Investing in art, a tax advantage for your company

The company that purchases original works of living artists to exhibit to the public can deduct the acquisition price from its taxable income. To benefit from the deduction, the company must exhibit the artwork in a location accessible free of charge to the public or employees, except in their offices, for five years. This period corresponds to the acquisition year and the following four years.

Company subject to corporate income tax (by default or by option)

Sole proprietorship subject to income tax in the category of industrial and commercial profits (BIC)

- Paintings, drawings, watercolors, gouache, pastels, monotypes, entirely executed by the artist’s hand.

- Engravings, prints, and lithographs, produced in limited quantities directly from plates entirely executed by the artist’s hand. The technique or material used is not important, except for any mechanical or photomechanical processes.

- Production in all materials of sculpture or statuary and assembly, as long as this production and assembly are entirely executed by the artist’s hand. Jewelry and goldsmithing articles are excluded.

- Limited edition casting of sculpture, limited to 8 copies and controlled by the artist or their heirs.

- Handwoven tapestry based on original designs provided by the artist, limited to 8 copies.

- Unique ceramic piece, entirely executed by the artist’s hand and signed by them.

- Copper enamel, entirely executed by hand, limited to 8 numbered copies and bearing the artist’s signature. Jewelry and goldsmithing articles are excluded.

- Photographs taken by the artist, printed by them or under their control, signed and numbered within a limit of 30 copies, regardless of format and support.

- Artworks purchased for resale are considered part of the company’s inventory (dealers, art galleries, or any company involved in art transactions) and are not eligible for deduction.

- The artist must be alive at the time of the artwork’s purchase. The company must be able to prove the artist’s existence at the acquisition date.

- The exhibition of the artwork can take place in the following locations and situations:

- Company premises, provided they are actually accessible to the public or employees. Events organized by the company or by a museum, local authority, or public institution to which the artwork has been entrusted. Museum where the artwork is on loan. Region, department, municipality, or their public institutions, or a scientific, cultural, or professional public institution.

- The exhibition must be permanent (during the required 5-year period) and not limited to occasional events (temporary exhibition, seasonal festival, etc.).

- Regardless of the public exhibition conditions adopted by the company, the public must be informed of the exhibition location and its accessibility to the artwork. The company must therefore communicate the appropriate information to the public. This should be done through attractive indications at the exhibition venue and through promotional means suitable for the significance of the artwork.

The acquisition cost of the artwork (or instrument) can be deducted, without recording it in the taxable income, over the year of acquisition and the following 4 years. This is done in equal fractions, with 1/5th (20%) deducted each year.

The deduction base is determined by the cost price of the artwork or instrument, which corresponds to the original value. The original value is the purchase price, plus any incidental expenses and minus the recoverable VAT.

Additional expenses paid during the acquisition of the artwork or instrument (such as commissions paid to intermediaries) are directly deducted from the overall taxable income before calculating the tax. They are not taken into account in the deduction base.

The amounts are deductible up to the limit of €10,000 or 5‰ (per thousand) of the net turnover when the latter amount is higher, reduced by the total donations made under sponsorship.

If the fraction of the acquisition cost cannot be fully deducted in a given year, the remaining excess is lost. It cannot be carried forward to be deducted in a subsequent year.

For companies subject to corporate tax (IS) or income tax under the category of BIC (Industrial and Commercial Profits), the amounts must be deducted from the annual results:

- Companies under the normal tax regime must deduct them on Form No. 2058-A (Cerfa No. 10951), line XG.

- Companies under the simplified tax regime must deduct them on Form No. 2033-B (Cerfa No. 10957).

Any deduction not claimed by the company in a given year is permanently lost.

The company must record an amount equal to the deduction in a special reserve account, shown in the liabilities section of the balance sheet.

In the following cases, this amount must be non-accountable reintegrated into the taxable income:

- Change of use (the artwork is no longer publicly exhibited or the instrument is no longer loaned out).

- Sale of the artwork or instrument (the asset is removed from the fixed assets).

- Withdrawal from the reserve account (the withdrawal of all or part of the amounts allocated to the special reserve account leads to the reintegration of the withdrawn amounts into taxable profits at the standard rate).

The company can establish a provision for depreciation when the loss in value of the artwork exceeds the amount of deductions already made.

Contact me